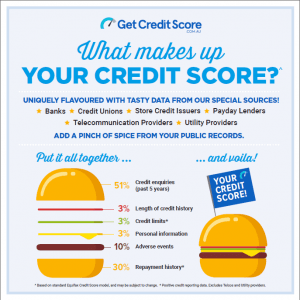

Credit Score Infographic – how is your credit score calculated?

Have you ever wondered to yourself what actually makes up your credit score? Or how is my credit score calculated? Well wonder no more, as we serve to you in a tasty burger style how your credit score is formulated. Hopefully it's simple enough to digest!- January 23, 2018

- Uncategorized

- Posted by Get That Car Loan

- Comments Off on Credit Score Infographic – how is your credit score calculated?

What Comprehensive Credit Reporting means for you and your credit score

A new fairer system of credit reporting is being rolled out across Australia called Comprehensive Credit Reporting.

In the latest Federal Budget you may have heard the Treasurer Scott Morrison mention the changes to credit reporting, but if you’re like us you probably didn’t take any notice. So what is Comprehensive Credit Reporting and why should you care?

In March 2014, changes were put in place to start rolling-out a fairer credit reporting system known as Comprehensive Credit Reporting. Credit reports and credit scores before these changes had limited data and only used ‘negative data’ to assess your credit-worthiness – how well you manage your credit commitments. This data would typically include information such as how many credit enquiries you have made or how many defaults you have.

Comprehensive Credit Reporting introduces more data that reflects positive behaviour. The new system now includes:

Credit account history: active or opened accounts, the date when you opened an account, the date when you closed an account and the maximum amount of credit available under each active account. It’ll also include basic information about each account, such as the T&Cs and the name of the credit provider the account is with.

Repayment history: your loan repayment history over a period of 2 years including any late or defaulted repayments you may have received and the date you paid the default in full.

So why is Comprehensive Credit Reporting better for me?

You have more power to influence your credit score

Having positive data in your credit file is a great step forward for Australian consumers as it paints a fuller picture of you, the borrower. The more data recorded on your credit report gives you greater power to positively impact your credit score. You can also build a credit history much faster.

“You have more power to influence your credit score.”

More competition & better deals

As more data becomes available, lenders will have more information to determine your credit worthiness. This will ultimately drive market competition and result in lenders offering a better deal based on your unique circumstances. In short you could be rewarded for a good credit score with a lower interest rate.

While these changes are still taking place in the Australian financial market, it is not an entirely new concept. Comprehensive Credit Reporting is already common practice in the United States and the United Kingdom, we are simply catching up.